The choice of the right payment rail is a crucial factor in the success of a mobile app. U.S. consumers now expect payments to be instant, seamless, and highly secure. This expectation underscores the significance of the payment rail in the app’s performance.

Whether they’re splitting a restaurant bill, buying groceries, paying a freelancer, or moving money between bank accounts, modern mobile app users expect payments to be seamless, fast, and secure. While some years ago, those things were nice-to-have additions to mobile products, they have now become non-negotiables. For startups and mobile app development teams building FinTech mobile apps, healthcare platforms, or digital marketplaces, choosing the right payment rail is one of the most critical architectural decisions. But why? Because the payment rail you select impacts your user experience, speed of adoption, regulatory compliance requirements, transaction costs, and long-term scalability, all of which are critical for user retention.

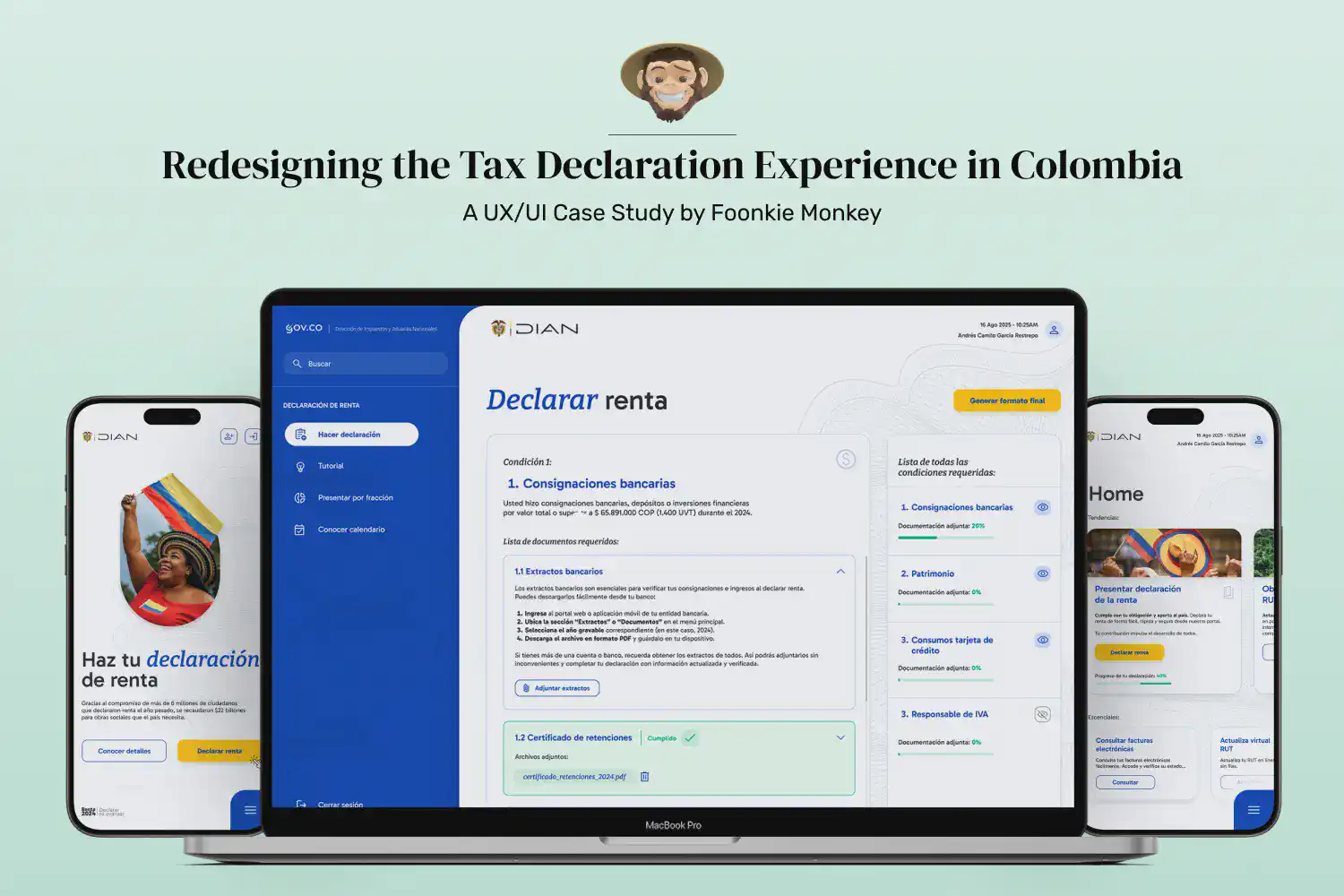

Unfortunately, in the United States, the online payments ecosystem is highly fragmented, and there are multiple rails coexisting, each with its own advantages and limitations. For founders and product leaders, the decision of which payment rail to choose is not just a technical one, but a strategic one. It’s the point at which the real question becomes: Which payment rail best aligns with my mobile app’s purpose, compliance needs, and growth strategy? We at Foonkie Monkey, want to help you understand the strengths, weaknesses, and ideal use cases for Zelle, Venmo, ACH, and RTP, so you can make an informed decision that supports your mobile app’s both your short-term launch goals and long-term scalability.

What are payment rails?

A payment rail is the underlying network or infrastructure that enables money to move between two parties, which can be anyone from a user paying a friend for coffee to a bank transferring funds between accounts. A way to think about a payment rail is as the “highway system” where digital payments travel on; each rail (or highway) has its own speed limits, tolls, and traffic rules. Some payment rails prioritize low cost, others transactional speed, while some are tailored to cater to the convenience of users.

In the United States, multiple payment rails operate in parallel, each with its own characteristics, and choosing the right rail for your mobile app depends on who your users are, how fast payments need to settle, how much compliance you need to handle, and what your business model requires. That’s what we’re here to help you with.

1. ACH (Automated Clearing House)

ACH, or Automated Clearing House, is a U.S.-based payment rail used to process electronic financial transactions in batches. The process involves the transfer of funds electronically between banks and financial institutions, making it very efficient for direct deposits, bill payments, and recurring transfers. It remains the most widely adopted payment rail in the United States, currently processing over 30 billion transactions annually.

Pros

- Cost-effective for high-volume transactions

- Universally accepted by U.S.-based financial institutions

- One of the best options for recurring transactions, such as subscription billing

- It is governed by NACHA, which gives ACH a well-defined compliance framework.

Cons

- ACH transfers typically can take up to 1 to 3 business days to settle. Users have a same-day transaction option, but it often comes with limits that reduce flexibility.

- ACH isn’t designed for instant availability of funds.

- Transactions can be reversed, leading to potential fraud and cash flow issues for businesses.

- It operates depending on banking hours.

2. RTP (Real-Time Payments)

Launched in 2017 by The Clearing House, RTP is the newest real-time payment rail built for instant settlement and fund transfers between participating U.S. financial institutions. It ensures secure, 24/7 electronic payments and allows two-way communication for payment confirmations and requests between businesses and consumers.

Pros

- RTP moves money in real time.

- It works 24 hours a day, seven days a week, 365 days a year.

- Transactions are irreversible, which can reduce fraud and chargeback risk.

- RTP allows ISO 20022 messaging, which enhances transparency and enriches data in transactions.

Cons

- Not all banks currently support RTP.

- Transaction fees are high compared to other U.S.-based payment rails.

- While the irreversibility of transactions reduces fraud, it also makes error handling and dispute resolution an issue.

3. Zelle

Zelle, a bank-backed payment rail, combines P2P with a social feed. It’s tightly integrated into over 2,000 banking and credit union apps, ensuring instant transfers between bank accounts using just a U.S. mobile number or email address. This integration not only eliminates the need for cash, checks, or sharing sensitive financial details but also provides a secure platform for transactions.

Pros

- Transfers are instant between banks.

- It is embedded in most major U.S. banking apps, eliminating the need for users to download a separate app.

- Zelle is backed by leading banks, which boosts consumer confidence.

- It has zero direct fees for users.

Cons

- It is primarily designed for P2P transactions, which limits use cases.

- Zelle is not an open API like Stripe or Plaid, which limits integration with other platforms.

- Payments are often irreversible.

4. Venmo

Venmo, available only in the United States, is a PayPal-owned payment rail that successfully merges social interaction with peer-to-peer payments. It makes it simple for users to send and receive money with friends, family, and even businesses via a unique social-based layer where transactions come with optional notes, emojis, and comments, creating a feed-like experience that blends payments with social interaction.

Pros

- It offers very user-friendly payment feeds and social interactions, which drive high adoption rates.

- Offers instant transfers for a small fee.

- Venmo has expanded into merchant payments, enabling small businesses to accept Venmo directly.

- Personal transactions are free.

Cons

- Venmo is not natively embedded in banking apps.

- It is free for standard P2P, but fees are applied to instant bank transfers.

- Venmo’s social feed makes payments public, which introduces privacy concerns for sensitive industries like healthcare or FinTech.

- It has transactional limits.

So, which U.S payment rail is right for your mobile app?

Now that you understand the ins and outs of the different payment rails in the United States, you can choose the right one for your mobile app. This strategic decision affects the user adoption rates, transaction costs, compliance requirements, and scalability of your product. However, it’s important to note that the best option depends on your target audience, use case, and long-term growth plans.

ACH: Choose ACH if you need a widely supported, cost-effective solution or if your mobile app relies on recurring or high-volume payments such as subscription services. Note that ACH falls short on transactional speed. So, if your mobile app prioritizes affordability over instant transactions, you will find ACH a strong fit. It works well for healthcare, bill pay, and retail apps. It also works for mobile applications that handle payroll and contractor payments, B2B marketplaces, and vendor payments.

RTP: RTP is suitable for U.S.-based mobile apps where speed and availability are non-negotiable, such as apps that handle instant payouts for contractors, insurance claims, and P2P transfers. It also works for healthcare and bill pay apps. However, since RTP adoption in the U.S. is still growing and not all banks support it yet, we suggest you combine it with ACH to provide both reach and speed.

Zelle: Zelle is hard to beat for peer-to-peer mobile apps or small business–focused products that rely on instant transfers backed by a trusted bank consortium and want to avoid managing complex compliance or settlement infrastructure. It is also suitable for apps that handle quick payments, budgeting, and personal finances. Avoid Zelle if your mobile app needs buyer protection.

Venmo: Venmo is ideal for consumer-facing mobile apps targeting younger demographics that value convenience and social interaction. It works well with apps that deal with lifestyle, P2P sharing, and also for community-driven platforms, apps that need subscriptions, retail mobile apps, and consumer marketplaces.

In practice, the smartest strategy often isn’t about committing to a single payment rail. Many of the most successful U.S.-based mobile apps take a multi-rail approach, using ACH for cost-efficient recurring transactions, RTP or Zelle for real-time transfers, and Venmo for consumer-facing engagement. This hybrid model not only maximizes flexibility and scalability but also ensures your app can keep pace with shifting user expectations, regulatory requirements, and industry innovations.

If you’re interested in building a mobile app in the U.S. and need expert guidance on using payment rails to ensure top-tier user experience, compliance, and user trust, let’s talk!