The line between a successful FinTech app and a forgotten one often comes down to user experience. That’s why leading U.S. FinTechs are rethinking UX not just as design, but as a strategic driver of conversion, trust, and retention.

It’s no secret that the success of FinTech mobile apps hinges on user experience. However, it’s crucial to grasp that in FinTech, UX isn’t just about sleek design; it’s about trust, clarity, and effortless usability. As of 2023, a significant 66% of people in the U.S. use digital banking, and this figure is projected to surge to 79% by 2029. This rapid growth in digital banking usage in the US presents a substantial market potential for FinTech apps. Americans are increasingly using digital banking or payment apps daily, and they expect fast, secure, and intuitive interactions that provide them with frictionless, transparent, and compliant experiences. For this reason, FinTech startups and mobile app developers must focus on optimizing the journey from sign-up to first deposit to build and maintain user trust and maximize conversions.

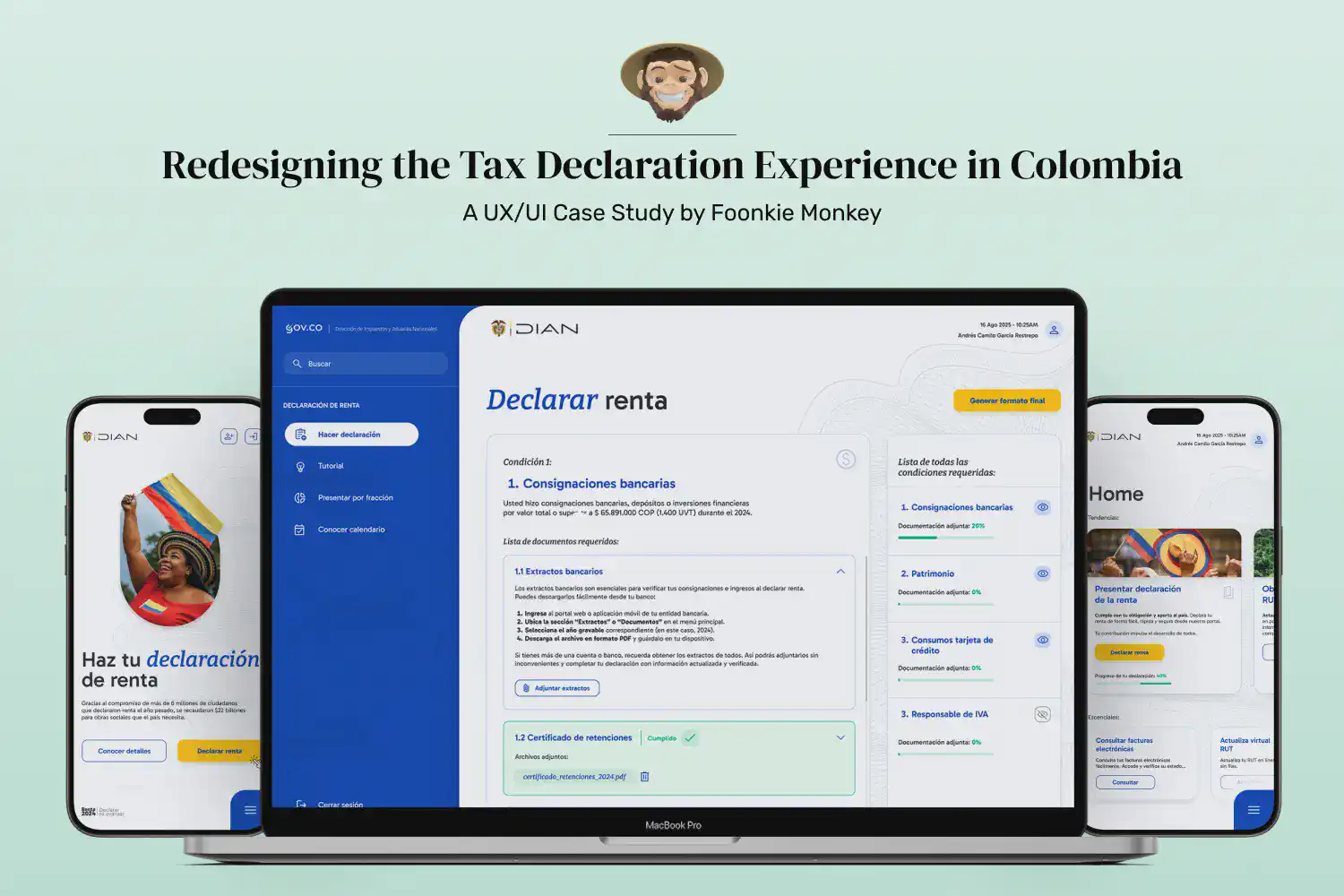

However, no matter how advanced your FinTech app’s technology or how competitive your market presence, if users struggle with basic tasks like signing up, verifying accounts, or making their first deposit, they’ll quickly switch to a competitor’s app. This is why you need to view UX not just as design, but as a strategic driver of conversion, trust, and retention. At Foonkie Monkey, we have extensive experience in U.S. FinTech mobile UX. We’re here to guide you on what U.S. users expect from FinTech mobile apps in terms of UX design at every stage, and how it can drive higher engagement, retention, and customer confidence.

- Use seamless sign-up and onboarding

In the world of FinTech, the initial interactions users have with your app can be the deciding factor in whether they choose to stay or leave. Research indicates that Android apps have an average first-day retention rate of just 22.6%, while iOS apps perform slightly better at 25.6%. This means that approximately three out of four users abandon a FinTech mobile app within the first 24 hours. These statistics underscore the crucial role of these first moments and underscore why a confusing or lengthy sign-up process is one of the primary reasons users in the United States abandon FinTech mobile apps. Here, we present our recommendations on how to instill in users a sense of security about their money and personal data, all while maintaining a seamless mobile app experience:

- Use progressive onboarding: Ensure that you only ask for essential information upfront (such as a phone number or email) and request additional verification after the initial engagement.

- Employ clear language: We find it highly engaging to replace jargon with terms that any user can easily understand. For instance, instead of using “KYC compliance verification”, use “confirm your identity. It will only take a minute.”

- Implement social or bank logins: You can significantly reduce friction by allowing users to sign up using their existing credentials from Google, Apple, or a linked bank account.

- Integrate identity verification: Help simplify the authentication process with trusted providers such as Plaid or Stripe identity.

Remember, when the onboarding process is smooth, straightforward, and transparent, users are far more likely to complete their first transaction or deposit within minutes. This underscores the importance of your work in creating a positive user experience and driving user engagement.

- Build trust through transparency

With hacking incidents becoming more common, U.S.-based users are growing increasingly distrustful and cautious of mobile apps that handle their financial information. In FinTech, trust is everything. From the very first second, your FinTech mobile app must project security, reliability, and honesty. Transparency in FinTech UX is a critical but often overlooked conversion driver. Here’s how we do it at Foonkie Monkey:

- We use clear security indicators such as padlock icons, HTTPS signals, and phrases like “bank-grade encryption”, which immediately communicate safety.

- We are transparent about all pricing and fees associated with using our FinTech mobile apps. Hidden charges or vague wording can quickly erode user trust.

- We design our app with the user in mind. We use plain-language explanations and familiar authentication flows such as Face ID to avoid confusion and make security feel intuitive, not intrusive. This approach ensures our users feel comfortable and in control.

- We explain to users why we need specific information, such as their email address and phone number, and we clearly state that we will keep it safe.

- Streamline Transaction flows

Building user trust during the onboarding process is a pivotal step in the journey of your FinTech mobile app. Once this trust is established, the next significant milestone is gaining their confidence in their financial transactions. Whether it’s their first purchase, deposit, or fund transfer, this stage is crucial as it directly influences conversion rates. A clear and user-friendly transactional flow, along with transparent payment statuses, can prevent potential pain points, confusion, and hesitation that might lead users to abandon the process or uninstall the app. Here’s our recommended approach to ensure a smooth transition.

- Provide them with multiple, flexible transactional options, such as ACH, RTP, debit and credit cards, Apple Pay, or Google Pay, among others.

- Provide users with instant feedback on their transactions. Provide them with real-time balance updates, confirmations, and notifications for successful, failed, or pending transfers.

- Use progressive disclosure to simplify complex transactions, making them easy to understand and navigate. This approach will put your users at ease and build their confidence in your app.

- Always be clear and straightforward on fees and timelines. Keep your users informed on when their funds will reach their destination, when payments are completed, and if any fees apply.

- Implement frictionless flows when linking a bank account or setting up a wallet. These processes should feel effortless and secure, without excessive redirects, complicated language, or unnecessary data entry.

- Implement personalization and predictive UX

Modern U.S. FinTech mobile app users want more than just functional apps; they expect apps that know them, understand their needs, and anticipate their requirements. For this reason, personalization has become critical and is now a key driver of engagement, increasing retention and brand loyalty by making experiences feel tailor-made. You can leverage behavioral insights and predictive analytics to help you deliver experiences that feel intuitive, relevant, and uniquely tailored to each user’s financial goals. Here are Foonkie Monkey’s tips on how to accomplish that:

- Leverage behavioral analytics: Tools like Amplitude or Mixpanel can help you understand user journeys and predict what actions your users are likely to take.

- Enhance user experience by allowing for theme personalization:Offer the option to choose between dark/light mode, or add custom color schemes that reflect each user’s unique personality —a small but powerful UX touch that can make a big difference.

- Integrate AI and machine learning models into your FinTech mobile app: One of the best ways to implement personalization is to utilize AI-driven predictive algorithms to identify geolocation, currencies, and patterns, and recommend budgeting actions or detect potential financial risks before they occur.

- Engage your users from the start with dynamic onboarding: By creating onboarding questions and flows tailored to users’ income levels, financial goals, or credit history, you can provide a more personalized and engaging experience.

- Allow users to choose their preferred communication channels: Let users select how they prefer to receive updates (via email or SMS) and adjust the frequency and type of notifications they receive.

Final word

For FinTech mobile app users in the U.S, UX is more than aesthetics; it’s the foundation of the trust and loyalty they place in your product. From the moment they land on your sign-up screen to their first successful transaction, every interaction is critical; it either builds their confidence in you or breaks it. U.S. users, more than ever, expect the financial products they adopt to be highly secure, transparent, as well as intuitive, personalized, and fast. Understanding and meeting these expectations is key to building a successful FinTech mobile app. So, by prioritizing trust signals, streamlining onboarding, and leveraging predictive personalization, your app can withstand the test of time and deliver a stellar user experience. At the end of the day, conversions in FinTech don’t come from beautiful, complex mobile apps; they come from reliability and empathy built into every tap, swipe, and screen.

At Foonkie Monkey, we specialize in designing and developing FinTech solutions that drive innovation and trust in the financial industry. If you’re ready to bring your FinTech mobile app idea to life, contact us today; we’d be delighted to help you create an app that stands out in the competitive financial landscape.